SPOILER ALERT!

Tips To Contrast Life Insurance Products Properly

Article written by-Mitchell Butt

Choosing the right life insurance policy is especially important for those who are responsible for the income of their household. If something happens to you and you are no longer able to work, life insurance money can support your family. Read this article for tips on how to pick the right policy.

Understand the types of life insurance available before making a decision on which to purchase. Most insurance policies focus on Term Life or Whole Life and knowing the difference is key. Bear in mind that with both of these types of policy, they can be tailored to your specific needs and situations. Do your homework.

You can get cheaper premiums if you are a healthy individual. Usually, healthier people get better deals on life insurance since they are expected to live longer.

The Internet is a great place to shop for life insurance. For better choices, try visiting websites and getting information about a lot of different life insurance companies, and then make comparisons. Insure.com, Insweb and Accuquote are three good places to start.

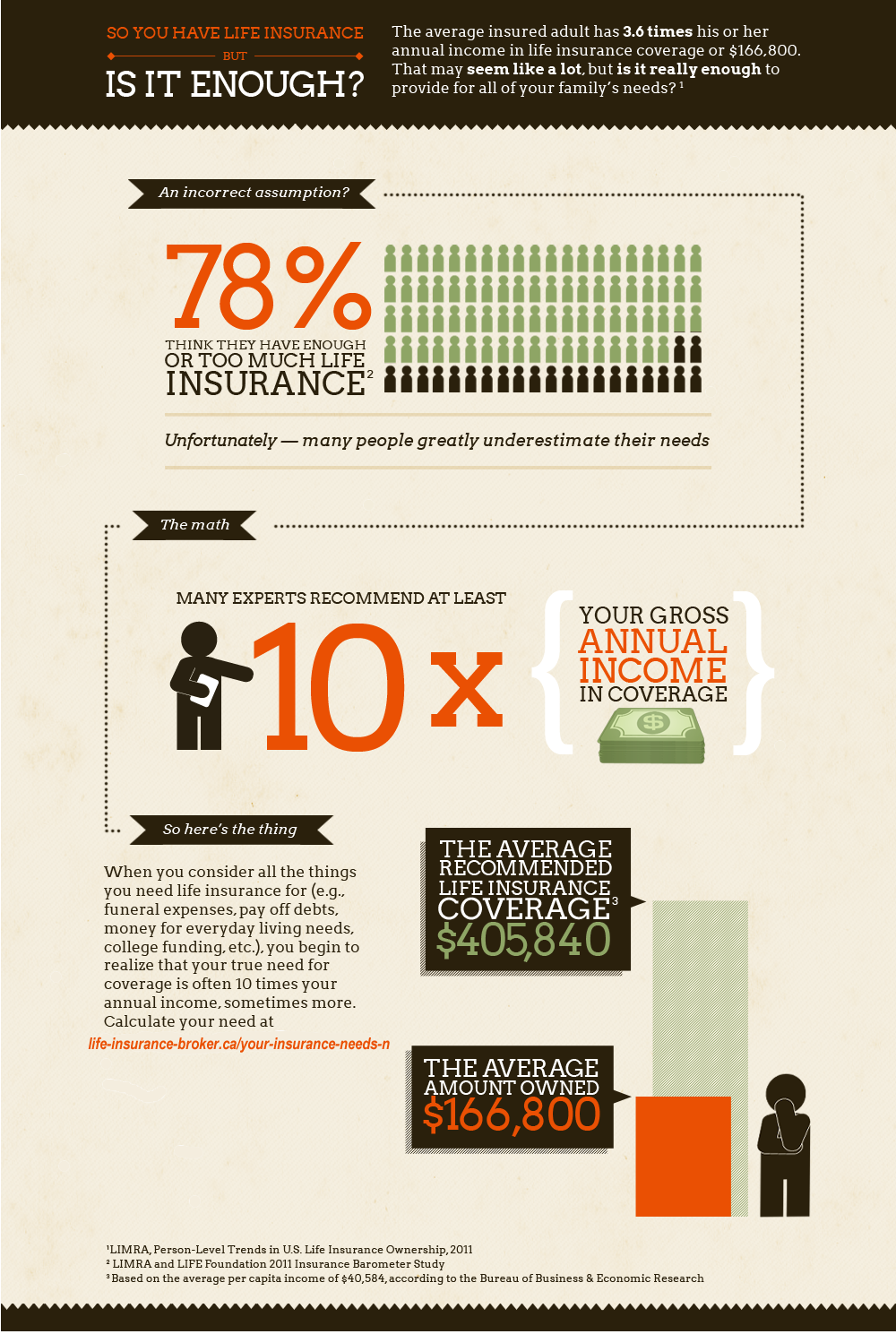

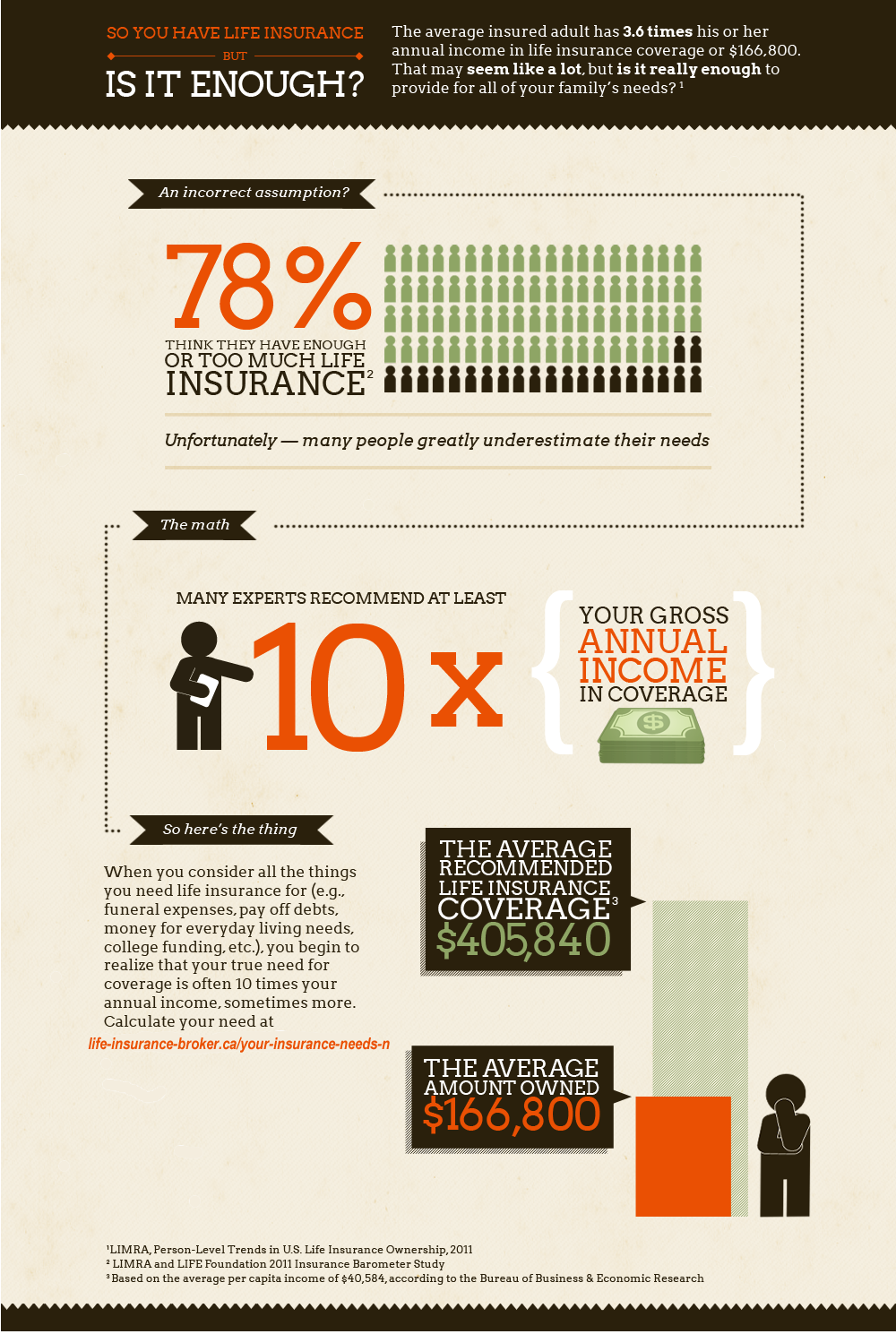

Buy the right amount of life insurance to cover all of your needs. Skimping on life insurance is not a good idea. Term insurance, especially, is very affordable, so make sure you get as much insurance as you need. For a rule of thumb, consider buying insurance that equals approximately 6 to 10 times your income.

If you are using the Internet to request life insurance, don't provide too many personal details. There are many identity theft rings that use the guise of life insurance to acquire your information. To find a good quote for life insurance, you really just need to disclose your zip code.

Once you have determined you need life insurance, next you need to figure out how much you need. There are several online calculators you can use, and some other formulas an insurance agent can help you with. If you want a ballpark figure quickly, take your salary and multiply it by 8. This will give you an estimate of how much life insurance you need.

When you are looking in to life insurance, always remember to research the quality of the company. There are rating agencies for rating insurance companies, so check them out to help you decide which company offers what you need yet has a solid financial background and has been able to meet all its financial obligations.

When getting life insurance, you will need to find out how much the premiums are. All insurance policies have different premiums and you need to be certain that you will be able to afford the coverage. If you lapse on payment for the policy and someone passes away, you could find that the coverage you were counting on is not available because of the lapse.

When looking for a life insurance policy, make sure to get long term coverage that is going to fulfill all of your needs. You do not want to be stuck paying money on a policy that is all wrong for you. If you are unsure about which is best for you, ask your insurance agent.

You may be able to save a significant amount of money on your life insurance by paying your premiums annually instead of monthly. Insurance companies often have extra fees for customers who pay every month instead of just once a year. Ask https://zenwriting.net/barbera3trenton/suggestions-on-obtaining-the-most-from-your-life-insurance if you can switch to an annual payment.

When looking into getting life insurance, there are two separate rate groups that are called standard and preferred. When you are comparing prices don't mix these up and compare a standard policy with a preferred one. They will cost very different and only about 1/3 of the population get a preferred rate!

Determine the amount of life insurance coverage your own people will need in the unlikely event of your death. Use one of the many available online life insurance calculators, or multiply your yearly wage by a factor of eight. This is the average debt left when someone passes away. The better your coverage, the better off your estate.

Think about life insurance if you are worried about preserving the net worth of your possessions. You have accumulated a lot of assets throughout your life, and your children should be entitled to enjoying the products of your hard work. You can help them deal with the taxes they are going to face when you die by subscribing to life insurance.

Frauds are more common that you think in the world of life insurance. Some insurance companies will raise your monthly premiums with no good reason or based on fake information. Keep track of how much you are paying and switch to another company if you do not think the new price is justified.

When considering buying life insurance, do not let any time go to waste. Putting off the decision is never a good thing. Life insurance is so important for yourself, but most importantly your family, that purchasing an insurance policy as soon as possible is encouraged. Also remember to always keep a current will or trust.

best life insurance for copd is a part of financial planning which protects your loved ones when the worst occurs. After a tragedy occurs, peace of mind in any form is very beneficial to your loved ones.

With life insurance it's all about finding the right type of insurance. There's term life insurance, whole life insurance, universal life insurance, and variable life insurance. go to this web-site have their positives and negatives and it's good to research or talk to an agent about which type would be the best fit for you and your family. All insurance plans should be individualized to meet your desires.

When purchasing life insurance, understand how much coverage you may need. A good rule of thumb commonly recommended is coverage for between 5 and 10 year's worth of your income. Go closer to 5 if you have few dependents and little debt, and more toward 10 if you have many dependents and lots of debt.

People can never predict an accident or other tragic event that leaves them unable to work. Before this happens, make sure you can protect your dependents by getting a life insurance policy. Remember the tips in this article in order to choose the best policy and rate for your situation.

Choosing the right life insurance policy is especially important for those who are responsible for the income of their household. If something happens to you and you are no longer able to work, life insurance money can support your family. Read this article for tips on how to pick the right policy.

Understand the types of life insurance available before making a decision on which to purchase. Most insurance policies focus on Term Life or Whole Life and knowing the difference is key. Bear in mind that with both of these types of policy, they can be tailored to your specific needs and situations. Do your homework.

You can get cheaper premiums if you are a healthy individual. Usually, healthier people get better deals on life insurance since they are expected to live longer.

The Internet is a great place to shop for life insurance. For better choices, try visiting websites and getting information about a lot of different life insurance companies, and then make comparisons. Insure.com, Insweb and Accuquote are three good places to start.

Buy the right amount of life insurance to cover all of your needs. Skimping on life insurance is not a good idea. Term insurance, especially, is very affordable, so make sure you get as much insurance as you need. For a rule of thumb, consider buying insurance that equals approximately 6 to 10 times your income.

If you are using the Internet to request life insurance, don't provide too many personal details. There are many identity theft rings that use the guise of life insurance to acquire your information. To find a good quote for life insurance, you really just need to disclose your zip code.

Once you have determined you need life insurance, next you need to figure out how much you need. There are several online calculators you can use, and some other formulas an insurance agent can help you with. If you want a ballpark figure quickly, take your salary and multiply it by 8. This will give you an estimate of how much life insurance you need.

When you are looking in to life insurance, always remember to research the quality of the company. There are rating agencies for rating insurance companies, so check them out to help you decide which company offers what you need yet has a solid financial background and has been able to meet all its financial obligations.

When getting life insurance, you will need to find out how much the premiums are. All insurance policies have different premiums and you need to be certain that you will be able to afford the coverage. If you lapse on payment for the policy and someone passes away, you could find that the coverage you were counting on is not available because of the lapse.

When looking for a life insurance policy, make sure to get long term coverage that is going to fulfill all of your needs. You do not want to be stuck paying money on a policy that is all wrong for you. If you are unsure about which is best for you, ask your insurance agent.

You may be able to save a significant amount of money on your life insurance by paying your premiums annually instead of monthly. Insurance companies often have extra fees for customers who pay every month instead of just once a year. Ask https://zenwriting.net/barbera3trenton/suggestions-on-obtaining-the-most-from-your-life-insurance if you can switch to an annual payment.

When looking into getting life insurance, there are two separate rate groups that are called standard and preferred. When you are comparing prices don't mix these up and compare a standard policy with a preferred one. They will cost very different and only about 1/3 of the population get a preferred rate!

Determine the amount of life insurance coverage your own people will need in the unlikely event of your death. Use one of the many available online life insurance calculators, or multiply your yearly wage by a factor of eight. This is the average debt left when someone passes away. The better your coverage, the better off your estate.

Think about life insurance if you are worried about preserving the net worth of your possessions. You have accumulated a lot of assets throughout your life, and your children should be entitled to enjoying the products of your hard work. You can help them deal with the taxes they are going to face when you die by subscribing to life insurance.

Frauds are more common that you think in the world of life insurance. Some insurance companies will raise your monthly premiums with no good reason or based on fake information. Keep track of how much you are paying and switch to another company if you do not think the new price is justified.

When considering buying life insurance, do not let any time go to waste. Putting off the decision is never a good thing. Life insurance is so important for yourself, but most importantly your family, that purchasing an insurance policy as soon as possible is encouraged. Also remember to always keep a current will or trust.

best life insurance for copd is a part of financial planning which protects your loved ones when the worst occurs. After a tragedy occurs, peace of mind in any form is very beneficial to your loved ones.

With life insurance it's all about finding the right type of insurance. There's term life insurance, whole life insurance, universal life insurance, and variable life insurance. go to this web-site have their positives and negatives and it's good to research or talk to an agent about which type would be the best fit for you and your family. All insurance plans should be individualized to meet your desires.

When purchasing life insurance, understand how much coverage you may need. A good rule of thumb commonly recommended is coverage for between 5 and 10 year's worth of your income. Go closer to 5 if you have few dependents and little debt, and more toward 10 if you have many dependents and lots of debt.

People can never predict an accident or other tragic event that leaves them unable to work. Before this happens, make sure you can protect your dependents by getting a life insurance policy. Remember the tips in this article in order to choose the best policy and rate for your situation.